Introduction

Falling behind on mortgage payments can be a daunting experience, but it doesn’t mean you’re out of options. In Arizona, you can still sell your house even if you’re behind on payments, provided it hasn’t been foreclosed and auctioned off. Homeowners will generally explore options with their current lender, such as a loan modification or a forbearance before selling. But when payments buildup, selling may be the best option for getting out from under the debt. This article will guide you through the process, legal considerations, and the benefits of selling to a cash buyer like Patriot Flip.

*** For legal help and questions, always consult with a local or trusted professional. Send an email to info@patriotflip.com for some of our trusted advisors.***

Table of Contents

- Introduction

- Understanding Mortgage Delinquency and Foreclosure

- Options for Selling Your House When Behind on Payments

- Legal Considerations in Arizona

- Benefits of Selling to a Cash Buyer

- Steps to Sell Your House When Behind on Payments

- Conclusion

Understanding Mortgage Delinquency and Foreclosure

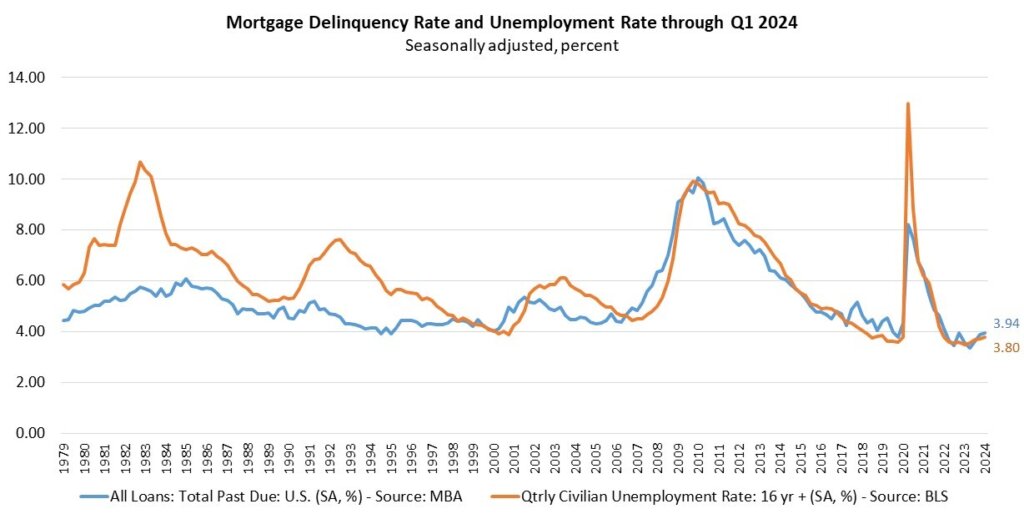

First, I want to pride you on taking action and doing your research if you are currently behind on payments, you are not alone. The delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 3.94% of all loans outstanding at the end of the first quarter of 2024, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey. If you continue to miss payments, the lender may initiate foreclosure proceedings to recover the owed amount. In Arizona, most foreclosures are nonjudicial, meaning they don’t go through the court system but follow a specific legal process.

Nonjudicial Foreclosure Process

In Arizona, the foreclosure process typically begins with the lender recording a Notice of Trustee’s Sale. This notice must be recorded at least 91 days before the sale date and mailed to the borrower within five business days. The sale is conducted as a public auction, and the highest bidder wins the property.

Reinstatement and Redemption

Before the foreclosure sale, you have the right to reinstate your loan by paying the overdue amount, including fees and costs. However, Arizona does not offer a redemption period after the foreclosure sale, meaning you cannot reclaim your property once it’s sold, except the IRS has a 120-Day redemption period.

Options for Selling Your House When Behind on Payments

If you’re behind on payments, you have several options to sell your house and avoid foreclosure.

Short Sale

A short sale involves selling your house for less than the mortgage balance. This option requires lender approval and can negatively impact your credit score, but it’s less damaging than a foreclosure.

Traditional Sale

Selling your house through a real estate agent is another option. This method can be time-consuming and may require repairs and staging, but it can help you get a higher price if the market conditions are favorable.

Selling to a Cash Buyer

Selling to a cash buyer is often the quickest and most hassle-free option. Cash buyers purchase properties as-is, allowing you to avoid repairs and close the sale quickly. This option is particularly beneficial if you’re facing imminent foreclosure.

Legal Considerations in Arizona

Understanding the legal aspects of selling your house when behind on payments is crucial. Make sure to do your research on local professionals. Call around and interview legal help to find out who’s going to best represent you. Email me if you want some recommendations.

Nonjudicial Foreclosure Process

As mentioned earlier, Arizona primarily uses a nonjudicial foreclosure process. The lender must follow specific steps, including recording a Notice of Trustee’s Sale and conducting a public auction. States differ between their foreclosure processes. For example, California is a Judicial Process. Judicial means “courts”. Nonjudicial means handled outside of the courts, which can expedite the process, versus a state that is judicial meaning handled “in the courts”, which can drag out and take longer to be fully completed.

Download Your FREE Stop Foreclosure Guide Below

Reinstatement and Redemption

You can reinstate your loan by paying the overdue amount before the foreclosure sale. However, Arizona does not allow for redemption after the sale, so it’s essential to act quickly if you’re considering selling your house.

Benefits of Selling to a Cash Buyer

Selling to a cash buyer offers several advantages, especially if you’re behind on payments:

- Speed: Cash buyers can close the sale quickly, often within a week.

- No Repairs Needed: Cash buyers purchase properties as-is, saving you time and money on repairs.

- Certainty: Cash offers are less likely to fall through compared to traditional sales that depend on financing.

Steps to Sell Your House When Behind on Payments

- Assess Your Situation: Determine how far behind you are on payments and the total amount owed.

- Contact Your Lender: Inform your lender of your intention to sell and discuss possible options like a short sale or loan modification. It is essential to stay in contact with your lender and to be as transparent as possible, as this can help to give you more time.

- Get a Property Valuation: Understand your home’s market value to set a realistic selling price.

- Choose a Selling Method: Decide whether to sell through a real estate agent, a short sale, or to a cash buyer.

- Market Your Property: If selling traditionally, list your property and market it to potential buyers.

- Negotiate Offers: Review and negotiate offers, prioritizing cash offers for a quicker sale.

- Close the Sale: Complete the necessary paperwork and close the sale, ensuring all debts are settled.

Conclusion

Selling your house in Arizona, even if you’re behind on payments, is possible and can help you avoid foreclosure. By understanding your options and the legal considerations, you can make an informed decision that best suits your financial situation. If you need a quick and hassle-free sale, consider selling to a cash buyer like Patriot Flip. Contact us today to get started and take the first step towards financial relief.

- Short Sale vs Foreclosure – What’s the Difference in Phoenix?

- Understanding Closing Costs in Arizona

- How to Get Rid of Bad Tenants in Arizona

- Listing Expired: How Can I Sell My House in Arizona?

- Selling a House in Probate Arizona [House Probate Sale]